venture capital jobs india

Like hedge fund managers private equity associates liaise with the. The fresh capital comes after a massive launch spree from the company which spent the pandemic beefing up its founder-focused services through rolling funds roll-up vehicles AngelList Stack and even a new 25 million fund to back startups solely based on hiring velocity.

The Bright New Age Of Venture Capital The Economist

With a focused investment approach as opposed to spray and play and additional capital reserved for the follow-on rounds we are committed to helping founders propel growth.

. A startup that has now become Publicly Listed or has been acquired by a Publicly Listed company. Aavishkaar Venture Management. As VC money disappears amid economic slowdown tech startups have laid off over 20000 employees the world over since April while more than 8000 employees have lost jobs at the Indian startups led by edtech platforms.

Venture capital and bank loans finance less than 20 of new businesses. According to layoff aggregator Layoffsfyi at least 20514 people have lost their jobs at tech startups globally since April globally and the. VUs Investment Partners have 45 yrs of VC experience leading some of the largest and best performing VC funds in the world investing 18B generating 4x net realized cash-on-cash returns and were some of the earliest and largest investors in 15 unicorns including Beyond Meat Facebook Twitter Uber Venmo FabFitFun Flyr Palantir Oculus Oscar Wayflyer Wish etc.

Indian venture capital firms that had exposure to the Terra ecosystem have also taken a hit amid a broader crash in the cryptocurrency market. A unicorn company is any private company that is valued at 1-Billion or more and is Venture Capital funded. Private equity and venture capital funds provide finance to early-stage ventures and growing businesses.

Given our focus and dedication we like to have a meaningful ownership between 15 - 20. Plus its adding more capital as it supports more capital. We contribute money time network and resources to help you build.

Any analysis is further complicated because venture capital is a loose term that covers rounds from a 500k pre-seed all the way up to. A startup that lost its Unicorn status due to a valuation degrading event. According to layoff aggregator Layoffsfyi at least 20514 people have lost.

In a volatile market alternatives to venture capital keep capital flowing to diverse founders. As VC money disappears amid economic slowdown tech startups have laid off over 20000 employees the world over since April while more than 8000 employees have lost jobs at the Indian startups led by edtech platforms. Investment banking is among the highest paying finance jobs in India.

The companies recognised are leading examples of how a business can grow with the funding business expertise. As of 2022 the firm managed more than 155 billion of investor capital. Bain Capital is an American private investment firm based in Boston MassachusettsIt specializes in private equity venture capital credit public equity impact investing life sciences and real estateBain Capital invests across a range of industry sectors and geographic regions.

Michael Moore BVCA Director General says Private equity and venture capital are supporting businesses across Yorkshire and Northeast England to innovate grow create jobs and bring value to the communities they operate within. This funding comes in exchange for profit participation or equity stake in the investee company. Luna its sister token has gone from 118 in April to 00003 as of writing this.

The company valuation at the time it first became. UST has lost over 80 in value over the last one week. Rasika and Amith founded Kottaram Agro Foods to bring Indias ancient grains such as millets back to mainstream consumption with innovative tasty and healthy packaged foods.

For the rest a parallel market of equity debt and hybrid capital is rising to grow businesses create. With Impact Investing at its core Aavishkaar Capital caters capital requirements to scale businesses. About current Our Story.

Theres more than one capital market for startups and small businesses.

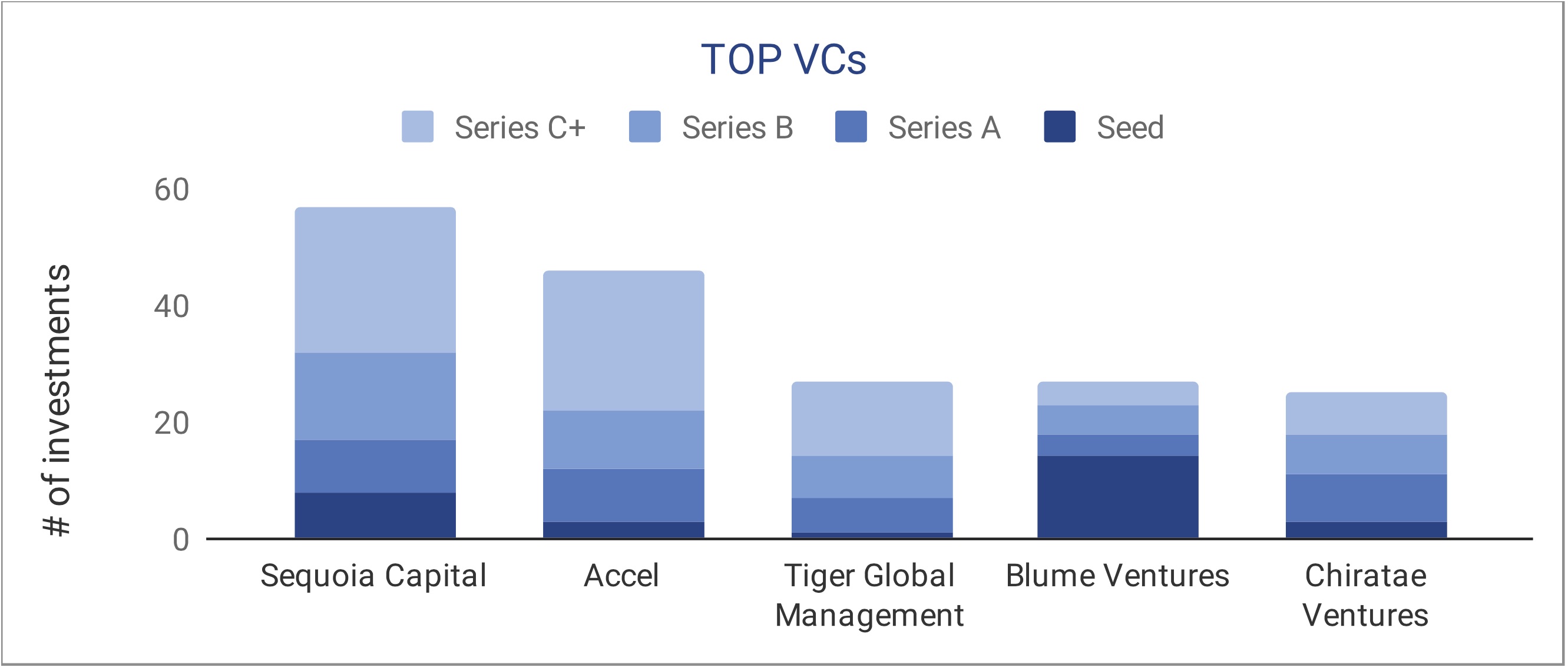

Top 10 Venture Capital Firms In India Active Vc Firms In 2021

India S Booming Startup Scene Is Showing Signs Of Trouble The Economist

How To Get Into Venture Capital Recruiting And Interviews Full Guide

10 Funding Options To Raise Startup Capital For Business

Investment Banking In India Top Banks List Salary Jobs

Venture Capital Features Types Funding Process Examples Etc

Vc Semiconductor Investments Deloitte Insights

Indian Private Equity Venture Capital Association Ivca

Top 10 Venture Capital Firms In India Active Vc Firms In 2021

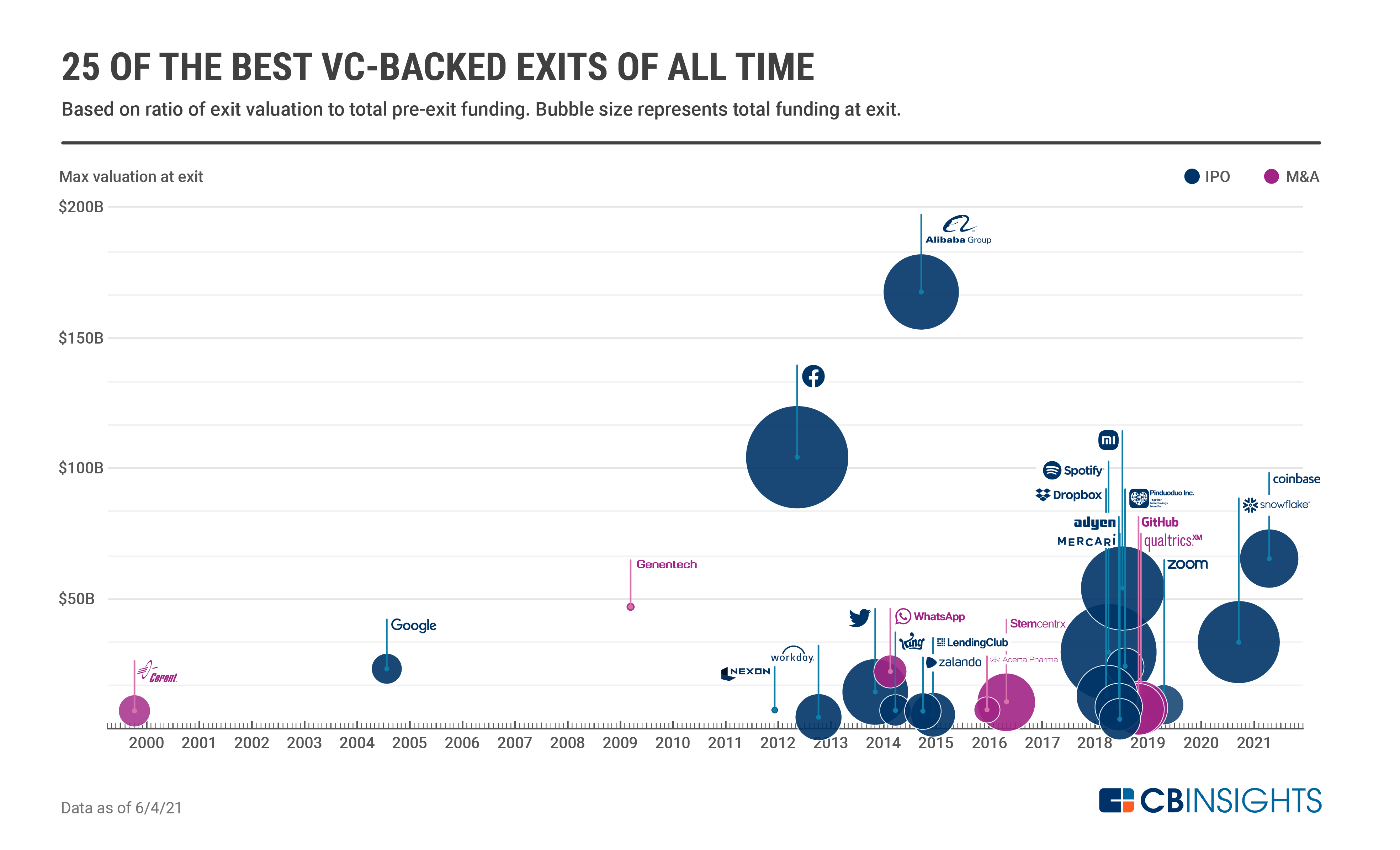

The 45 Best Vc Investments Of All Time What To Learn From Them Cb Insights Research

Top 47 Most Active Venture Capital Firms In India For Startups

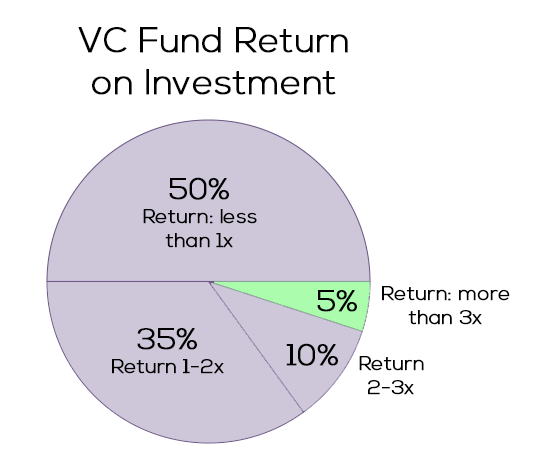

Venture Capital Features Types Funding Process Examples Etc

Venture Capital Features Types Funding Process Examples Etc

Indian Tech Startups Raised A Record 14 5b In 2019 Techcrunch

Venture Capital Features Types Funding Process Examples Etc

Indian Venture And Alternate Capital Association Ivca Linkedin

How To Get Into Venture Capital Recruiting And Interviews Full Guide